China's high-quality development receives wide praise

China's high-quality development receives wide praise

24 Apr 2024

As the world is reeling from weak economy and regional conflicts, members of political parties and media outlets from different nations hailed China's high-quality development, saying it offers more opportunities to other countries and contributes to recovery and growth of the world economy.

They shared the view on Tuesday at a dialogue in an aim to have a deep understanding of China's new development and strengthen the exchange of experience in party and state governance.

Daudh Ahmed, deputy minister of Transport and Civil Aviation and Media Coordinator of People's National Congress of Maldives, said the comprehensive strategic partnership between the Maldives and China demonstrated core principles of Chinese modernization including high-quality development and achieving common prosperity for all.

"The partnership between the two countries provides a stable foundation for us to enhance our appeal as an economic hub and investment destination in South Asia. It is also a testament to the myriad of global opportunities that arise from Chinese modernization," he said.

As the Maldives and China have signed a series of critical agreements, he said: "Each (agreement) lays down pathways for development and cooperation across various sectors, including infrastructure, tourism, agriculture, fisheries and digital economy."

Fai Mesa, member of the Committee of Public Communication, Youth House for Cambodia-China Friendship, said as Cambodia needs innovation to unleash its economic potential, high-quality development will help developing countries like Cambodia to gain economic momentum.

Contrary to mass production without thinking of the environmental sustainability and shared development, he said high-quality development focuses on inclusiveness and sustainability for humankind in the long run.

"High-quality development, by focusing on the quality to achieve greater efficiency, equality, sustainability and security, is somewhat undeniably 'a leading initiative for humanity as a whole'," he said.

New innovative factors, such as information technology, big data and artificial intelligence, are important economic momentum to foster green development for China and other countries around the world, especially the developing countries, he added.

Seedy Sheriff Ceesay, administrative secretary of the National People's Party of the Gambia, believed high-quality development can meet people's ever-growing desire for a better life.

"High-quality development will establish a more equitable income distribution system and ensure equalization of public resources between urban and rural areas," he said, adding that it also allows the benefits of economic growth to have a more significant and fair impact on all individuals, leading to common prosperity.

Citing a Chinese-built international conference center, Ceesay said that Gambia has benefited from its close cooperation with China and he believed China's high-quality development and high-level opening up will bring more opportunities to the world.

Many international financial institutions recently have raised their forecast for China's economic growth this year. According to Asian Development Outlook, from 2024 to 2025, China will account for 46 percent of the economic growth of Asian developing countries and will remain the largest contributor to the global economic growth.

Taking the East Coast Rail Link which is being built by a Chinese company as an example, Mohammad Faisal, executive secretary of Malaysia Election Department of the United Malays National Organisation, said that the Belt and Road cooperation between Malaysia and China demonstrates high-quality development and promotes connectivity in the region.

He said he noticed some countries and media outlets smear and attack China and vowed to tell stories of a real China to the world.

Hu Zhaoming, spokesman of the International Department of the Communist Party of China Central Committee, called for developing countries to fight against public opinion and narrative hegemony of certain countries.

He said developing countries should jointly break the myth of the Western development model, enhance confidence in their own development prospects and make their voices heard more internationally.Source: China Daily

Belt and Road cooperation have proven that high-quality industrial capacity is not excessive

Belt and Road cooperation have proven that high-quality industrial capacity is not excessive

22 Apr 2024

On April 19, 2024, Chinese Ambassador to the United States Xie Feng visited Harvard University and had a fireside chat with Founding Dean of Harvard Kennedy School Prof. Graham Allison.

When responding to a question on the Belt and Road initiative (BRI), Ambassador Xie said that China has always adhered to the principle of extensive consultation, joint contribution and shared benefits in advancing Belt and Road cooperation, so as to facilitate the revitalization of all countries and inject momentum into common development.

He recalled that when he served as China's Ambassador to Indonesia, he personally took part in the construction of the Jakarta-Bandung high-speed railway. Initially, there were worries that the demand would be weak. But after the railway was completed, it has not only witnessed a robust demand but also stimulated the high-speed railway economy along the line. It has not only boosted infrastructure connectivity, but also brought the hearts of the Chinese and Indonesian peoples closer. This has proven that high-quality industrial capacity is not excessive globally. On the contrary, it will generate more effective demands and boost economic growth.

Ambassador Xie pointed out that the BRI is not a geopolitical tool, but a widely popular global public good. Instead of being intended for bloc confrontation, it is an open and inclusive platform for international cooperation. The facts have debunked those narratives smearing and spreading doom and gloom about the initiative. The obsession with hegemony is not in China's DNA. China is neither Athens nor Sparta. Assuming China would surely tread the old path taken by traditional Western powers is a serious miscalculation, and those believing "strength determines the intention" are basically imposing their mindset on others. China will always be a member of the developing world, and is ready to share development dividends with other countries.Source:us.china-embassy.gov.cn

Pakistan remains steadfast in collaborating with China for peace, connectivity, prosperity: president

Pakistan remains steadfast in collaborating with China for peace, connectivity, prosperity: president

22 Apr 2024

ISLAMABAD, April 19 (Xinhua) -- Pakistani President Asif Ali Zardari said on Thursday that Pakistan always remains steadfast in collaborating with China to advance shared goals of fostering peace, connectivity, prosperity and maintaining stability.

"The enduring strategic and all-weather friendship between Pakistan and China is a cornerstone of stability in the region," the president said when addressing the joint session of the country's parliament in the capital Islamabad.

The president expressed gratitude to the Chinese people and leadership for their unwavering support of Pakistan in various fields during difficult times.

Zardari reiterated the country's resolve to complete the ongoing China-Pakistan Economic Corridor (CPEC) project, and said, "We will not allow hostile elements to jeopardize this vital project (CPEC) or undermine the strong bond between our two nations and will take all necessary measures to ensure the security of our Chinese brothers and sisters."

Source: Xinhua

Q1 data reflects confidence and strength of Chinese economy

Q1 data reflects confidence and strength of Chinese economy

19 Apr 2024

China's economic growth for the first quarter of 2024 has exceeded market expectations. By pursuing high-quality development, and nurturing new quality productive forces, the country has delivered an impressive performance.

Let's take a look at views of experts from home and abroad to China's economic performance and onwards.

Daryl Guppy

China's GDP has grown at a faster rate of 5.3 percent than the 4.6 percent expected by many Western observers. This growth comes as no surprise following the resurgence of discretionary spending over the recent festival holidays. This was an early indication of economic strength. This discretionary spending is a useful measure of the health and expectations of the Chinese economy.

Increased consumer spending during the Qingming Festival was a litmus test for sustained confidence in Chinese economic growth. The festival continued the momentum of discretionary spending seen in the Chinese New Year Festival. This suggests that the Spring Festival consumer spending increase was early evidence of a return in confidence in economic growth, so the high growth rate in Q1 is not a surprise.

The increase in Q1 GDP is evidence of sustainable growth in the economy and economic activity. It reflects increased productivity created in the digital and green economies. This is where the future of economic growth is found.

Wang Dan

The Q1 growth beat market expectations by a wide margin, and manufacturing and infrastructure were the main engines. Housing market consolidation is also deepening.

In the second half of the year, economic data may improve further, primarily driven by the government. After all, we are still in an economic cycle that tends to rise from the bottom, making government projects very important. Many local government projects actually gain momentum from mid-year onwards. As these projects unfold, economic data for the second half of the year is expected to be better.

Exports are expected to continue rising this year. So far this year, we have observed that companies engaged in exports, especially those targeting Europe and America, have performed quite well.

Wei Jianguo

From the economic data of the first quarter, three major highlights can be seen in the Chinese economy.

Firstly, the effect of high-quality economic development has been achieved. Traditional industries are upgrading, emerging industries are growing steadily and future industrial cultivation is also strengthening.

Secondly, the innovative effects of the institutional mechanisms have been highlighted, promoting reforms in rules, regulations, management and standards.

Thirdly, China's high-level opening-up measures have had a positive impact on our country's business environment, particularly in attracting foreign investment.

Zhang Yansheng

In the first quarter of this year, our country's volume of goods trade import and export broke through 10 trillion yuan ($1.38 trillion) for the first time in the same period of history, with a year-on-year increase of 5 percent.

Among them, exports were 5.74 trillion yuan, an increase of 4.9 percent; imports were 4.43 trillion yuan, an increase of 5 percent. The growth rate of imports and exports reached a new high in six quarters.

Zhang Yansheng believes that the marginal improvement in external demand in the first quarter, coupled with the overall better-than-expected performance of global shipping, logistics and trade chains, reflects that China's foreign trade has started well, with strong resilience and vitality in imports and exports.

Source: China Daily

China-Europe freight train services see robust expansion in Q1

China-Europe freight train services see robust expansion in Q1

18 Apr 2024

Source: Belt and Road Portal

WIC holds forum on Digital Silk Road development

WIC holds forum on Digital Silk Road development

17 Apr 2024

With the theme "Connectivity and Shared Prosperity", the World Internet Conference (WIC) Digital Silk Road Development Forum was held on April 16 in Xi'an, Northwest China's Shaanxi province.

Wang Yong, vice-chairman of the Chinese People's Political Consultative Conference National Committee, and Zhuang Rongwen, chair of the WIC, addressed the opening ceremony, which was presided over by Ren Xianliang, secretary-general of the WIC.

Wang noted that the Chinese government attaches great importance to the development of the digital economy, and advocates for the high-quality development of the Belt and Road empowered by digital technology.

He said that the forum has injected new impetus into the high-quality development of the Belt and Road, and created a new platform for international economic cooperation.

The Chinese government is willing to work with all parties to promote the Digital Silk Road, share the development dividends of the digital economy, and deepen innovation and cooperation in digital technology, according to him.

The country will strengthen exchange and mutual learning in digital culture, and jointly build a normative system on digital governance, contributing to the building of a community with a shared future in cyberspace, Wang added.

Zhao Yide, secretary of the Communist Party of China Shaanxi Provincial Committee, delivered the welcoming remarks. Zhao Gang, deputy secretary of the committee and the governor of the province, attended the opening ceremony and gave a speech at the main forum.

Zhuang Rongwen, also minister of the Cyberspace Administration of China, noted that the WIC should inherit the Silk Road spirit, accelerate the building of the Digital Silk Road, and promote the digital transformation and development of countries and regions involved in the Belt and Road Initiative.

He suggested jointly building digital infrastructure and increasing connectivity, promoting digital technological cooperation and realizing coordinated and equally beneficial development, sharing the outcomes of digital civilization and co-existing in peace, exploring international digital governance and safeguarding security in cyberspace.

Zhao Yide noted that Shaanxi is expanding its digital infrastructure, fostering digital industries, upgrading digital platforms and deepening digital governance to build it into a stronger, more open and efficient province.

The province will promote the integrated development of the Digital Silk Road, the Land Silk Road and the Air Silk Road, striving to become an open highland for China’s inland reform, he said.

Big names, including Li Junhua, under-secretary-general for Economic and Social Affairs of the United Nations, and Francis Gurry, vice-chair of the WIC, gave remarks on-site or via video link.

The main forum was held after the opening ceremony. It included discussions on the following three topics: "Digital Connectivity and Cooperation in Building the Silk Road", "Silk Road E-commerce International Cooperation", and "Digital Villages and Sustainable Development".

The forum aims to carry forward the Silk Road spirit of peace and cooperation, openness and inclusiveness, mutual learning and mutual benefit, to promote the co-building of the Digital Silk Road, and create a new platform for digital economic cooperation.

TheWIC Collection of Cross-Border E-Commerce Practice Cases (2024)was also released at the main forum.

The forum was organized by the WIC and co-organized by the People's Government of Shaanxi Province. Guests from nearly 50 countries and regions attended the meeting.

Source: WIC official webiste

Lu Jianzhong, chairman of SRCIC, attended the third Belt and Road Forum for International Cooperation at invitation

Lu Jianzhong, chairman of SRCIC, attended the third Belt and Road Forum for International Cooperation at invitation

19 Oct 2023

From October 17-18, 2023, the third Belt and Road Forum for International Cooperation (BRF III)was convened in Beijing, China. Lu Jianzhong, chairman of the Silk Road Chamber of International Commerce (SRCIC), was invited to attend the grand event, at which he has reviewed the outstanding achievements and envisioned the bright future of the Belt and Road Initiative (BRI)with participants from around the world.

Chairman Lu Jianzhong meets SRCIC members at the thematic forum on People-to-People Bonds:Mario Rendulic, president of Chinese Southeast European Business Association (left)andDavid Saganelidze, CEO of Georgia's state-run Partnership Fund (right)

Amity between people holds the key to the sound relations between states.People-to-people exchangeis an important part of the Belt and Road construction, and also the social foundation for promoting the joint construction of it.Since its establishment in 2015, SRCIC has actively engaged in cultural exchanges and carried out a series of practical and efficient projects to promote people-to-people exchanges. The Silk Road Sunshine student grant set up by SRCIC has funded more than 50 outstanding students from Russia, Lebanon, Ukraine, Kazakhstan, Palestine, Kyrgyzstan, Tajikistan, Azerbaijan, Jordan and other countries along the Belt and Road to study in Northwestern Polytechnical University, Xi'an Jiaotong University, Chang'an University, Shaanxi Normal University, and Northwestern University.SRCIC has been taking solid actions to promote educational cooperation with the Belt and Road countries, cultivate "ambassadors" for cultural exchanges, and advance people-to-people exchanges. In the face of new historical opportunities, SRCIC will work with its members and partners from all over the world to expand cooperation areas, innovatecooperation methods, and continued to consolidate the mass base of the BRI, and contribute to the building of a community with a shared future for mankind.

Notes

The BRF III is themed on “High-quality Belt and Road Cooperation: Together for Common Development and Prosperity”. It was attended by representatives from over 150 countries. Three high-level forums were held under the topics of Connectivity in an Open World Economy, Green Silk Road for Harmony with Nature, and Digital Economy as a New Source of Growth, respectively. Six thematic forums with focuses on Trade Connectivity, Maritime Cooperation, Clean Silk Road, Think Tank Exchanges, People-to-People Bonds, and Subnational Cooperation were respectively convened.

Among which, the thematic forum on People-to-People Bonds was hosted by the International Department of the Central Committee of the Communist Party of China and attended by about 300 representatives of political parties, non-governmental organizations, and relevant domestic departments, experts and scholars.

The foreign participants speak highly of President Xi Jinping’sforesight as to have proposed the BRI and of the fruitful achievements made during the last 10 years that has benefited participating countries. They are willing to make greater contributions to the high-quality joint construction of the Belt and Road with high-level cultural exchanges.

Source: Partial content excerpted from media reports such as Xinhua News Agency

Chairman Lu Jianzhong Re-elected as Deputy to the National People's Congress

Chairman Lu Jianzhong Re-elected as Deputy to the National People's Congress

17 Feb 2023

On January 16of 2023, 69 deputies from Shaanxi Province were elected to the 14th National People's Congress(NPC) in accordance with the law at the first session of the 14th Shaanxi Provincial People's Congress. Lu Jianzhong, Chairman of the Silk Road Chamber of International Commerce and Chairman of Tang West Market Group, was re-electedas a deputy to the NPC since his last term beginning in January 2018. Before that, Chairman Luwerea member of the National Committee of the Chinese People's Political Consultative Conference (CPPCC)for three terms.

Since his election as a deputy to the NPC, Luhas been earnestly performinghis duties. He has made suggestions on hot issues such as the innovative development of cultural industry, encouraging and supporting the private economy, and high-quality construction of the Belt and Road Initiative. He put forward the Proposal on the Enactment of the Law on Promoting the Digital Economy.A total of 24 proposals were suggestedin areas such as giving full play to the private sector to promote the Belt and Road Initiative and the high-quality development of the private economy, whichprovide detailed reference for relevant ministries and commissions onformulatingpolicies and regulations. Some of the suggestions have been incorporated into relevant planning or policy-relateddocuments.

May the people of Türkiye and Syria recover from the earthquake and rebuild their homes at an early date

May the people of Türkiye and Syria recover from the earthquake and rebuild their homes at an early date

8 Feb 2023

A magnitude 7.7 earthquake struck Türkiye’s southern border at 4:17 a.m. local time (0917 GMT+8) on February 6. The earthquake was the most devastating one in Türkiye since 1999, wreaking havoc on at least 10 provinces. The death toll climbed to 2,316 in Türkiye and 711 in Syria, and the number of injured rose to 13,293 in Türkiye and 1,431 in Syria as of February 6 local time, according to Türkiye's Disaster and Emergency Management Agency and Syrian Ministry of Health.

Left: damaged buildings in the Pazarcik district of Kahramanmaras province, Türkiye on February 6.

Right: rescue efforts at a collapsed building in Malatya, Türkiye on February 6.

(Source: Xinhua News)

On February 6, Chinese president Xi Jinping sent messages of condolences to the Turkish president Recep Tayyip Erdogan and Syrian president Bashar al-Assad. The message reads as follows:

“I was distressed to learn of the powerful earthquake which has caused heavy casualties and property losses. On behalf of the Chinese government and people, I would like to express our deep condolences to the victims and the injured, and their families. We are confident that your people will recover from the disaster and rebuild homes in no time under the leadership of your administration.”

SRCIC, with its 218 organizational members from 82 countries, has several Turkish members. Upon learning the severe earthquake in Türkiye, SRCIC chairman Mr. Lu Jianzhong and the Secretariat sent condolences to Mr. Rifat Hisarcıklıoğlu, President of the Union of Chambers and Commodity Exchanges of Türkiye, Mr. Adnan Akfirat, Chairman of the Turkish-Chinese Business Development and Friendship Association, and the Çalık Group.

The Chinese government swiftly launched emergency humanitarian assistance mechanism and provided 40 million RMB of emergency assistance to Türkiye at the first batch, including sending out urban rescue teams and medical teams, and providing relief materials. China also coordinated the delivery of relief supplies to Syria and a speedy implementation of ongoing food aid projects.

Meanwhile, Chinese people from all walks of life extended a helping hand to Türkiye and Syria. The Red Cross Society of China donated 200,000 US dollars to both countries respectively. Chinese people in the disaster-hit areas are raising donations of tents, blankets and other relief supplies. It is learned that China's Rescue Team of Ramunion, a civilian rescue organization, has arrived at the disaster area this morning to carry out rescue.

Political leaders of many countries expressed their sympathy and support to Türkiye after learning the massive casualties caused by the powerful 7.8 magnitude earthquake. We hereby call on all SRCIC members and the international community to provide assistance and support within their capacity to the affected people in Türkiye and Syria.

Source: Xinhua News

Lu Jianzhong attends Member Representative Symposium of 2022 World Internet Conference

Lu Jianzhong attends Member Representative Symposium of 2022 World Internet Conference

9 Nov 2022

On November 8th, as a prelude to the 2022 World Internet Conference (WIC) Wuzhen Summit, the WIC Member Representative Symposium was held on the venue in ZhejiangProvince. This is the first symposium since the establishment of WIC International Organization, aiming to enhance exchange and cooperation between the organization and its members, and among the membersthemselves. Zhuang Rongwen, chairman of the WIC Organization Committee,attended and addressed the symposium. The eventwasmoderated by WIC Secretary GeneralRen Xianliang. More than 30 member representatives from international organizations, leading global Internet companies, industry authorities and associations listedthe symposium. Lu Jianzhong, chairman of the Board of Directors of Tang West Market Group and chairman of the Silk Road Chamber of International Commerce,discussed with other representatives about the opportunities and challenges brought by the development of global internet and the prospects of WIC.

Zhuangpointed out that as a common platform for the global Internet family, the WIC originates in China but belongs to the world. He hoped that members would contribute their suggestions to the Conference, participate initsconstructionand support its development. Members need to build consensus on ideas, focus on new challenges and problems in cyberspace, and align the efforts of international community to resolve differences.Thedeepeningintegration of digital economy and real economy, and coordination of global industrial and supply chainsare the focuses in developing the digital economy. Members shouldboostscientific and technological innovation, strengthen international collaborationand global cooperation, and exchangevisions and applications of Internet-related technology. Members should deepen cultural exchanges, promote cooperation in internet media, and strengthen the construction of internet culture. Members shouldalsofocus on leading global cooperation, pursuingcommon prosperity for all mankind, deepeningcommon interests and promoting mutual benefit in the Internet sector.

LuJianzhongbriefed thethree platformsbuilt by Tang West Market Group, namely the Datang Chain, the Hainan International Cultural and Art Trading Center,and the Silk Road Chamber of International Commerce (SRCIC). The platforms are part of the contributing efforts tothedigital cultural industry,the cultural cause,and the construction of Digital China.He suggestedbuildinga multi-chain, cross-chain and internationally-oriented blockchain infrastructure for cultural and art transactions and a cultural digital Silk Road, which can be based on theDatang Chain, a national blockchain anda pilot project of copyright innovativeapplication. The international resources and industrial advantages of SRCICcould also contribute to this cause. The proposal outlines a cultural digital platform for artworks trading and exchange among various countries. The platform integrates functions including ownership validation, authentication, pricing, sequencing and confirming. Together, they resolve the three pain points of the industry - appraisal, valuation and standardization of artworks. This endeavor will boost international cultural and art exchanges and transactions, and enhance mutual learning among civilizations along the Belt and Road.

The WIC International Organizationwas established on July 12 this year. It is an international, industrial and non-profit social organization set upvoluntarily by enterprises, organizations, institutions and individuals committed to facilitatingthe global Internetdevelopment. It was registered in China and headquartered in Beijing.

Source: World Internet ConferenceWeChat Official Account

SRCIC Vice Chair Maria Fernanda Garza elected as new ICC Chair

SRCIC Vice Chair Maria Fernanda Garza elected as new ICC Chair

16 Jun 2022

The International Chamber of Commerce (ICC) is delighted to welcome Maria Fernanda Garza as its new Chair. After serving as ICC First Vice-Chair for the past two years, the small business owner from Mexico succeeds Ajay Banga as ICC Chair, making her the first woman to hold this position.

Maria Fernanda Garza has been elected ICC Chair for a period of two years following a meeting of the ICC World Council, held yesterday in Mexico City. The ICC World Council additionally elected Philippe Varin, Chair of ICC France, as ICC First Vice-Chair, and Nayla Comair Obeid and Harsh Pati Singhania as ICC Vice-Chairs.

Ms Garza is CEO of Orestia, as well as SRCIC Vice Chair, a small manufacturing home improvement solutions company based in Mexico, with exports to the USMCA region, Latin-America and Asia. A lifelong advocate for small and medium businesses in her home country and around the world, she participated 19 years in the Mexican Employers' Association (COPARMEX) and served as Vice-President for four years.

In her new role, Ms Garza will continue to drive ICC's mission to make business work for everyone, every day, everywhere.

Commenting on her election, Maria Fernanda Garza said: "Given the magnitude of the downside risks facing the global economy, it's absolutely vital for us to have a united business voice committed to openness, fair competition and the enablement of peace through international trade.”

"In a period that has been characterized by weak international cooperation, I believe that ICC has a vital role to play in harnessing the expertise, innovation and networks of the private sector to secure an effective response to major global challenges. Simply put, our mission to enable peace and prosperity through trade has never been more vital — and, indeed, more urgent."

Ms Garza's interest in improving the business environment made her a prominent business leader at a young age. She was the ICC Regional Coordinator for the Americas and a member of the governing body of the ICC International Court of Arbitration. An ICC Executive Board member since 2014, Ms Garza became the first woman to be elected as ICC First Vice-Chair in 2020.

A strong advocate of business ethics and corporate governance standards, Ms Garza was Chair of ICC Mexico until June 2020 and is a former member of the International Affairs Advisory Committee of the Ministry of Labour and former member of the National Advisory Committee of ACLAN. She is also a Board Member of the Corporate Responsibility Alliance AliaRSE and was a member of the Corporate Responsibility Network of the Business and Industry Advisory Committee to the OECD.

ICC Secretary General John W.H. Denton AO said: "In her new capacity as Chair, Maria Fernanda's experience and insights as CEO of a successful small business will further reinforce the work we do and help ensure that ICC reaches the whole of the international business community. She has already contributed greatly to ICC's work at the global, regional and national levels, and we are very happy that she will remain a strong champion for ICC and challenge us to push ahead to promote more inclusive growth and prosperity."

Effective 14 June 2022 for a two-year term, Ms Garza succeeds Ajay Banga in the role. We take this opportunity to thank Mr Banga for his outstanding leadership of our organisation during the past two years, a particularly challenging and uncertain time for businesses worldwide. Mr Banga will continue to serve on the ICC Executive Board as Honorary Chair.

The ICC World Council also elected six new members of the ICC Executive Board for three-year terms, strengthening gender, ethnic and geographical diversity in ICC's leadership.

Holger Bingmann, Managing Partner, Bingmann Pflüger International GmbH (Germany)

Rebecca Enonchong, CEO, AppsTech and Chair of Afrilabs (Cameroon)

Marjorie Yang, Chairwoman, Esquel Group (Hong Kong)

Lama Al Sulaiman, Shareholder and a Board Member of Rolaco Holdings, KSA, and LUX (Saudi Arabia)

Nicolas Uribe, Chair, Bogota Chamber (Colombia)

Justin D’Agostino, CEO, Herbert Smith Freehills (Hong Kong)

Fredrik Cappelen, Chair at Dometic and Transcom (Sweden), and Candace Johnson, Vice-Chair at NorthStar Earth and Space (Luxembourg/United States) are starting second terms as members of the ICC Executive Board.

The ICC World Council additionally ratifiedthe election of Nicolas Uribe, President of the Bogota Chamber of Commerce and Chair of ICC Colombia, as Chair of the ICC World Chambers Federation. His term begins on 1 July 2022.

Source: iccwbo.org

Lum Wan Liang, Consul General of Consulate General of Malaysia in Xi'an and his delegation paid a visit to SRCIC Secretariat

Lum Wan Liang, Consul General of Consulate General of Malaysia in Xi'an and his delegation paid a visit to SRCIC Secretariat

28 Apr 2022

SRCIC Secretary General Diane Bian held a talk with Lum Wan Liang, Consul General of Consulate General of Malaysia in Xi'an and his delegation

On April 27, 2022, SRCIC Secretary General Diane Bian held a talk with Lum Wan Liang, Consul General of Consulate General of Malaysia in Xi'an, Loh Kai Yong and Raymond Raman, President and Secretary General of the Xi'an Branch of Malaysian Chamber of Commerce and Industry in China (MAYCHAM CHINA).

SG Bian first extended welcome to Consul General Lum Wan Liang and his delegation. She pointed out that SRCIC has been committed to building a cooperation platform between governments and enterprises. Despite the suspension of offline activities due to the COVID pandemic, the long-standing cooperation and friendship between SRCIC and its members and partners continues. It is expected that in the post pandemic period, SRCIC and Malaysian Consulate can resume cooperation and share new opportunities for investment and development by co-sponsoring business promotion seminars and other activities.

SG Diane Bian and Consul General Lum Wan Liang

Although it was only his first visit to SRCIC, Consul General Lum said he had an understanding of it through MAYCHAM CHINA and affirmed SRCIC's achievements since its establishment. Subsequently, he introduced the Consulate General of Malaysia in Xi'an, and said that today's meeting is only a beginning to the many more opportunities to discuss cooperation in depth in the future.

The meeting was also attended by Emma Wei, Director of SRCIC Membership Center Section I, Alina Cao, Director of SRCIC Membership Center Section II, and Valentina Wang, Deputy Director of of SRCIC Membership Center Section II.

China's high-quality development receives wide praise

China's high-quality development receives wide praise

24 Apr 2024

As the world is reeling from weak economy and regional conflicts, members of political parties and media outlets from different nations hailed China's high-quality development, saying it offers more opportunities to other countries and contributes to recovery and growth of the world economy.

They shared the view on Tuesday at a dialogue in an aim to have a deep understanding of China's new development and strengthen the exchange of experience in party and state governance.

Daudh Ahmed, deputy minister of Transport and Civil Aviation and Media Coordinator of People's National Congress of Maldives, said the comprehensive strategic partnership between the Maldives and China demonstrated core principles of Chinese modernization including high-quality development and achieving common prosperity for all.

"The partnership between the two countries provides a stable foundation for us to enhance our appeal as an economic hub and investment destination in South Asia. It is also a testament to the myriad of global opportunities that arise from Chinese modernization," he said.

As the Maldives and China have signed a series of critical agreements, he said: "Each (agreement) lays down pathways for development and cooperation across various sectors, including infrastructure, tourism, agriculture, fisheries and digital economy."

Fai Mesa, member of the Committee of Public Communication, Youth House for Cambodia-China Friendship, said as Cambodia needs innovation to unleash its economic potential, high-quality development will help developing countries like Cambodia to gain economic momentum.

Contrary to mass production without thinking of the environmental sustainability and shared development, he said high-quality development focuses on inclusiveness and sustainability for humankind in the long run.

"High-quality development, by focusing on the quality to achieve greater efficiency, equality, sustainability and security, is somewhat undeniably 'a leading initiative for humanity as a whole'," he said.

New innovative factors, such as information technology, big data and artificial intelligence, are important economic momentum to foster green development for China and other countries around the world, especially the developing countries, he added.

Seedy Sheriff Ceesay, administrative secretary of the National People's Party of the Gambia, believed high-quality development can meet people's ever-growing desire for a better life.

"High-quality development will establish a more equitable income distribution system and ensure equalization of public resources between urban and rural areas," he said, adding that it also allows the benefits of economic growth to have a more significant and fair impact on all individuals, leading to common prosperity.

Citing a Chinese-built international conference center, Ceesay said that Gambia has benefited from its close cooperation with China and he believed China's high-quality development and high-level opening up will bring more opportunities to the world.

Many international financial institutions recently have raised their forecast for China's economic growth this year. According to Asian Development Outlook, from 2024 to 2025, China will account for 46 percent of the economic growth of Asian developing countries and will remain the largest contributor to the global economic growth.

Taking the East Coast Rail Link which is being built by a Chinese company as an example, Mohammad Faisal, executive secretary of Malaysia Election Department of the United Malays National Organisation, said that the Belt and Road cooperation between Malaysia and China demonstrates high-quality development and promotes connectivity in the region.

He said he noticed some countries and media outlets smear and attack China and vowed to tell stories of a real China to the world.

Hu Zhaoming, spokesman of the International Department of the Communist Party of China Central Committee, called for developing countries to fight against public opinion and narrative hegemony of certain countries.

He said developing countries should jointly break the myth of the Western development model, enhance confidence in their own development prospects and make their voices heard more internationally.Source: China Daily

Belt and Road cooperation have proven that high-quality industrial capacity is not excessive

Belt and Road cooperation have proven that high-quality industrial capacity is not excessive

22 Apr 2024

On April 19, 2024, Chinese Ambassador to the United States Xie Feng visited Harvard University and had a fireside chat with Founding Dean of Harvard Kennedy School Prof. Graham Allison.

When responding to a question on the Belt and Road initiative (BRI), Ambassador Xie said that China has always adhered to the principle of extensive consultation, joint contribution and shared benefits in advancing Belt and Road cooperation, so as to facilitate the revitalization of all countries and inject momentum into common development.

He recalled that when he served as China's Ambassador to Indonesia, he personally took part in the construction of the Jakarta-Bandung high-speed railway. Initially, there were worries that the demand would be weak. But after the railway was completed, it has not only witnessed a robust demand but also stimulated the high-speed railway economy along the line. It has not only boosted infrastructure connectivity, but also brought the hearts of the Chinese and Indonesian peoples closer. This has proven that high-quality industrial capacity is not excessive globally. On the contrary, it will generate more effective demands and boost economic growth.

Ambassador Xie pointed out that the BRI is not a geopolitical tool, but a widely popular global public good. Instead of being intended for bloc confrontation, it is an open and inclusive platform for international cooperation. The facts have debunked those narratives smearing and spreading doom and gloom about the initiative. The obsession with hegemony is not in China's DNA. China is neither Athens nor Sparta. Assuming China would surely tread the old path taken by traditional Western powers is a serious miscalculation, and those believing "strength determines the intention" are basically imposing their mindset on others. China will always be a member of the developing world, and is ready to share development dividends with other countries.Source:us.china-embassy.gov.cn

Pakistan remains steadfast in collaborating with China for peace, connectivity, prosperity: president

Pakistan remains steadfast in collaborating with China for peace, connectivity, prosperity: president

22 Apr 2024

ISLAMABAD, April 19 (Xinhua) -- Pakistani President Asif Ali Zardari said on Thursday that Pakistan always remains steadfast in collaborating with China to advance shared goals of fostering peace, connectivity, prosperity and maintaining stability.

"The enduring strategic and all-weather friendship between Pakistan and China is a cornerstone of stability in the region," the president said when addressing the joint session of the country's parliament in the capital Islamabad.

The president expressed gratitude to the Chinese people and leadership for their unwavering support of Pakistan in various fields during difficult times.

Zardari reiterated the country's resolve to complete the ongoing China-Pakistan Economic Corridor (CPEC) project, and said, "We will not allow hostile elements to jeopardize this vital project (CPEC) or undermine the strong bond between our two nations and will take all necessary measures to ensure the security of our Chinese brothers and sisters."

Source: Xinhua

China-Europe freight train services see robust expansion in Q1

China-Europe freight train services see robust expansion in Q1

18 Apr 2024

Source: Belt and Road Portal

WIC holds forum on Digital Silk Road development

WIC holds forum on Digital Silk Road development

17 Apr 2024

With the theme "Connectivity and Shared Prosperity", the World Internet Conference (WIC) Digital Silk Road Development Forum was held on April 16 in Xi'an, Northwest China's Shaanxi province.

Wang Yong, vice-chairman of the Chinese People's Political Consultative Conference National Committee, and Zhuang Rongwen, chair of the WIC, addressed the opening ceremony, which was presided over by Ren Xianliang, secretary-general of the WIC.

Wang noted that the Chinese government attaches great importance to the development of the digital economy, and advocates for the high-quality development of the Belt and Road empowered by digital technology.

He said that the forum has injected new impetus into the high-quality development of the Belt and Road, and created a new platform for international economic cooperation.

The Chinese government is willing to work with all parties to promote the Digital Silk Road, share the development dividends of the digital economy, and deepen innovation and cooperation in digital technology, according to him.

The country will strengthen exchange and mutual learning in digital culture, and jointly build a normative system on digital governance, contributing to the building of a community with a shared future in cyberspace, Wang added.

Zhao Yide, secretary of the Communist Party of China Shaanxi Provincial Committee, delivered the welcoming remarks. Zhao Gang, deputy secretary of the committee and the governor of the province, attended the opening ceremony and gave a speech at the main forum.

Zhuang Rongwen, also minister of the Cyberspace Administration of China, noted that the WIC should inherit the Silk Road spirit, accelerate the building of the Digital Silk Road, and promote the digital transformation and development of countries and regions involved in the Belt and Road Initiative.

He suggested jointly building digital infrastructure and increasing connectivity, promoting digital technological cooperation and realizing coordinated and equally beneficial development, sharing the outcomes of digital civilization and co-existing in peace, exploring international digital governance and safeguarding security in cyberspace.

Zhao Yide noted that Shaanxi is expanding its digital infrastructure, fostering digital industries, upgrading digital platforms and deepening digital governance to build it into a stronger, more open and efficient province.

The province will promote the integrated development of the Digital Silk Road, the Land Silk Road and the Air Silk Road, striving to become an open highland for China’s inland reform, he said.

Big names, including Li Junhua, under-secretary-general for Economic and Social Affairs of the United Nations, and Francis Gurry, vice-chair of the WIC, gave remarks on-site or via video link.

The main forum was held after the opening ceremony. It included discussions on the following three topics: "Digital Connectivity and Cooperation in Building the Silk Road", "Silk Road E-commerce International Cooperation", and "Digital Villages and Sustainable Development".

The forum aims to carry forward the Silk Road spirit of peace and cooperation, openness and inclusiveness, mutual learning and mutual benefit, to promote the co-building of the Digital Silk Road, and create a new platform for digital economic cooperation.

TheWIC Collection of Cross-Border E-Commerce Practice Cases (2024)was also released at the main forum.

The forum was organized by the WIC and co-organized by the People's Government of Shaanxi Province. Guests from nearly 50 countries and regions attended the meeting.

Source: WIC official webiste

Japan encouraged to seize BRI opportunities

Japan encouraged to seize BRI opportunities

16 Apr 2024

People from all walks of life in Japan can objectively view the Belt and Road Initiative and seize more cooperation opportunities, as joint BRI construction provides a pathway for building a community with a shared future for mankind, says Chinese Ambassador to Japan Wu Jianghao.

Any country committed to shared development can take part in the BRI as an equal partner and gain from it, regardless of their political system, history, culture or stage of development, Wu said.

Since the launch of the BRI in 2013, the joint construction of the initiative has entered a stage of high-quality development.

Over the past 11 years, the BRI has achieved fruitful results, becoming the widest-ranging and largest-scale international cooperation platform in the world, Wu told a forum organized by the Japan-China Belt and Road Initiative Promotion Association in Tokyo last week.

"The joint construction of the BRI practices true multilateralism, does not exclude or target any party, does not engage in geopolitical games, does not form closed and exclusive 'small circles', does not impose values and development models, and certainly does not form military alliances."

Therefore, the joint construction of the BRI can maximize consensus, overcome obstacles and become increasingly accepted by the international community, he added.

Developing countries have embraced the initiative as it aims to resolve their significant challenges, including infrastructure, funding, technology and expertise, Wu said.

Some Western countries have been accusing China of creating "debt traps" in developing countries, which is pure misinformation, he said.

Data from the World Bank showed Western commercial and multilateral institutions hold two-thirds of the debt obligations of low- and middle-income countries in the next seven years, while China only accounts for 14 percent of such debts.

Wu called on Japan to listen to the voices of its companies, as many are involved in Belt and Road cooperation and have benefited from it.

Many Japanese companies are using China-Europe freight trains and river-sea transportation to expand business opportunities. Collaborations between Chinese and Japanese companies and financial institutions in third-party markets have yielded positive results, spanning sectors such as infrastructure, eco-financing, logistics and clean energy.

"The facts prove that the BRI is an opportunity for Japan, not a threat," Wu said.

China is willing to work with all countries to achieve high-quality development of the BRI on a larger scope, in broader fields and at a deeper level, he said. As a close neighbor and key partner of China, Japan is welcome to take part in the joint construction of the BRI.

Attendees to the forum included the Japan-China Belt and Road Initiative Promotion Association's President Kazuyuki Hamada, and its representative Yoshikazu Ono. They said the association will vigorously promote a better understanding of the BRI among various sectors of Japanese society and actively take part in the joint construction of the initiative.

Source:China Daily Global

Q1 data reflects confidence and strength of Chinese economy

Q1 data reflects confidence and strength of Chinese economy

19 Apr 2024

China's economic growth for the first quarter of 2024 has exceeded market expectations. By pursuing high-quality development, and nurturing new quality productive forces, the country has delivered an impressive performance.

Let's take a look at views of experts from home and abroad to China's economic performance and onwards.

Daryl Guppy

China's GDP has grown at a faster rate of 5.3 percent than the 4.6 percent expected by many Western observers. This growth comes as no surprise following the resurgence of discretionary spending over the recent festival holidays. This was an early indication of economic strength. This discretionary spending is a useful measure of the health and expectations of the Chinese economy.

Increased consumer spending during the Qingming Festival was a litmus test for sustained confidence in Chinese economic growth. The festival continued the momentum of discretionary spending seen in the Chinese New Year Festival. This suggests that the Spring Festival consumer spending increase was early evidence of a return in confidence in economic growth, so the high growth rate in Q1 is not a surprise.

The increase in Q1 GDP is evidence of sustainable growth in the economy and economic activity. It reflects increased productivity created in the digital and green economies. This is where the future of economic growth is found.

Wang Dan

The Q1 growth beat market expectations by a wide margin, and manufacturing and infrastructure were the main engines. Housing market consolidation is also deepening.

In the second half of the year, economic data may improve further, primarily driven by the government. After all, we are still in an economic cycle that tends to rise from the bottom, making government projects very important. Many local government projects actually gain momentum from mid-year onwards. As these projects unfold, economic data for the second half of the year is expected to be better.

Exports are expected to continue rising this year. So far this year, we have observed that companies engaged in exports, especially those targeting Europe and America, have performed quite well.

Wei Jianguo

From the economic data of the first quarter, three major highlights can be seen in the Chinese economy.

Firstly, the effect of high-quality economic development has been achieved. Traditional industries are upgrading, emerging industries are growing steadily and future industrial cultivation is also strengthening.

Secondly, the innovative effects of the institutional mechanisms have been highlighted, promoting reforms in rules, regulations, management and standards.

Thirdly, China's high-level opening-up measures have had a positive impact on our country's business environment, particularly in attracting foreign investment.

Zhang Yansheng

In the first quarter of this year, our country's volume of goods trade import and export broke through 10 trillion yuan ($1.38 trillion) for the first time in the same period of history, with a year-on-year increase of 5 percent.

Among them, exports were 5.74 trillion yuan, an increase of 4.9 percent; imports were 4.43 trillion yuan, an increase of 5 percent. The growth rate of imports and exports reached a new high in six quarters.

Zhang Yansheng believes that the marginal improvement in external demand in the first quarter, coupled with the overall better-than-expected performance of global shipping, logistics and trade chains, reflects that China's foreign trade has started well, with strong resilience and vitality in imports and exports.

Source: China Daily

CAEXPO supports ASEAN centrality: Daryl Guppy

CAEXPO supports ASEAN centrality: Daryl Guppy

21 Sep 2023

Editor's note:Daryl Guppy, a special commentator on current affairs for CGTN, is an international financial technical analysis expert. He has provided weekly Shanghai Index analyses for mainland Chinese media for more than a decade. Guppy appears regularly on CNBC Asia and is known as "The Chart Man." He is a former national board member of the Australia China Business Council. The article reflects the author's opinions and not necessarily those of CGTN.

The 20th China-ASEAN Expo (CAEXPO) and China-ASEAN Business and Investment Summit in Nanning are two of the most significant events in the ASEAN region. It is more than just a trade expo with the usual fascinating array of goods and products on display. These are important, but it's the dialogues and meetings that deliver the full significance of CAEXPO because they provide a strategic guide to regional policy development.

In 2014, I was invited to speak in the first Australian partner participation in CAEXPO. I got to know the outline of the 21st Century Maritime Silk Road and how this meshed with what is now the Belt and Road Initiative (BRI). It was the first time the concept had been explained fully to an international audience and the impact was significant. It set the parameters for business engagement and development in the following decade and more.

This year's CAEXPO has continued that tradition of policy commitments with the opening ceremony speech by Chinese Premier Li Qiang. He emphasized the significance of building a closer China-ASEAN community. These remarks followed the recent ASEAN meeting in Jakarta where the issue of ASEAN centrality in regional decision making was a major point of discussion.

Li acknowledged ASEAN centrality in the process of forging smooth China-ASEAN relationships. This is another important indication of China's desire to work within existing regional trade structures of which CAEXPO is a practical example. This is a direct counter to the approach taken by the United States which seeks to undermine ASEAN centrality in regional decision making by turning organizations like the Regional Comprehensive Economic Partnership (RCEP) into a geopolitical platform.

Echoing decade-old remarks, Li placed ASEAN countries at the intersection of the "Belt and Road" on both land and sea. They reflected the historical connections of China trade from the ancient land-based Tea Horse Road and the maritime trade centers in the Straits of Malacca. His remarks provided a clear indication of the vitality and growth of the BRI. This came as a shock to Western observers who have been led to believe that the BRI is a spent force. Nothing could be further from the truth as the multi-faceted BRI continues to expand its engagement with ASEAN in many key areas.

The BRI is not just about physical infrastructure. It includes capital infrastructure investment to connect Chinese and ASEAN financial markets. It includes trade and soft infrastructure co-ordination to make cross border trade and settlement more efficient. The establishment of common digital standards across ASEAN is an essential foundation for progress in these areas.

Consistent with the objectives of the BRI and ASEAN, the expo has a strong emphasis on the digital economy and green economy. The theme of the expo particularly supports businesses operating in emerging sectors of new information technology and new energy.

CAEXPO shows that China is committed to expanding cooperation in culture, tourism, training, and youth exchange because these foster mutual understanding and friendship between the people of the region. The success of the expo in terms of the number and variety of participants, shows that China is a growing economy determined to continue its engagement with the region.

On one level, CAEXPO provides an important platform for exhibitors to highlight products and services available within the region and which form the foundation of trade relationships.Many are the traditional products of trade, but they also include the breakthroughs seen with the Huawei Mate60 built on China developed chip technology.

One feature overlooked in the colourful displays of ethnic dress and custom is that CAEXPO is held in Nanning, the capital of south China's Guangxi Zhuang Autonomous Region. This is just one of five Autonomous regions in China, a factor rarely recognized in Western media coverage which paints China as a monolithic state. These regions illustrate the cooperative pathway that is an essential part of prosperity in the ASEAN region.

On another level, CAEXPO provides the political and strategic framework that underpins the broad improvement of trade relationships, peace and prosperity within the region. Premier Li's remarks confirmed China's commitment to regional prosperity and cooperation within the ASEAN framework.

Source: CGTN

Francis Chua Was Invited to Attend The East Expo in Nanning, Received By Premier Li Qiang of The State Council

Francis Chua Was Invited to Attend The East Expo in Nanning, Received By Premier Li Qiang of The State Council

20 Sep 2023

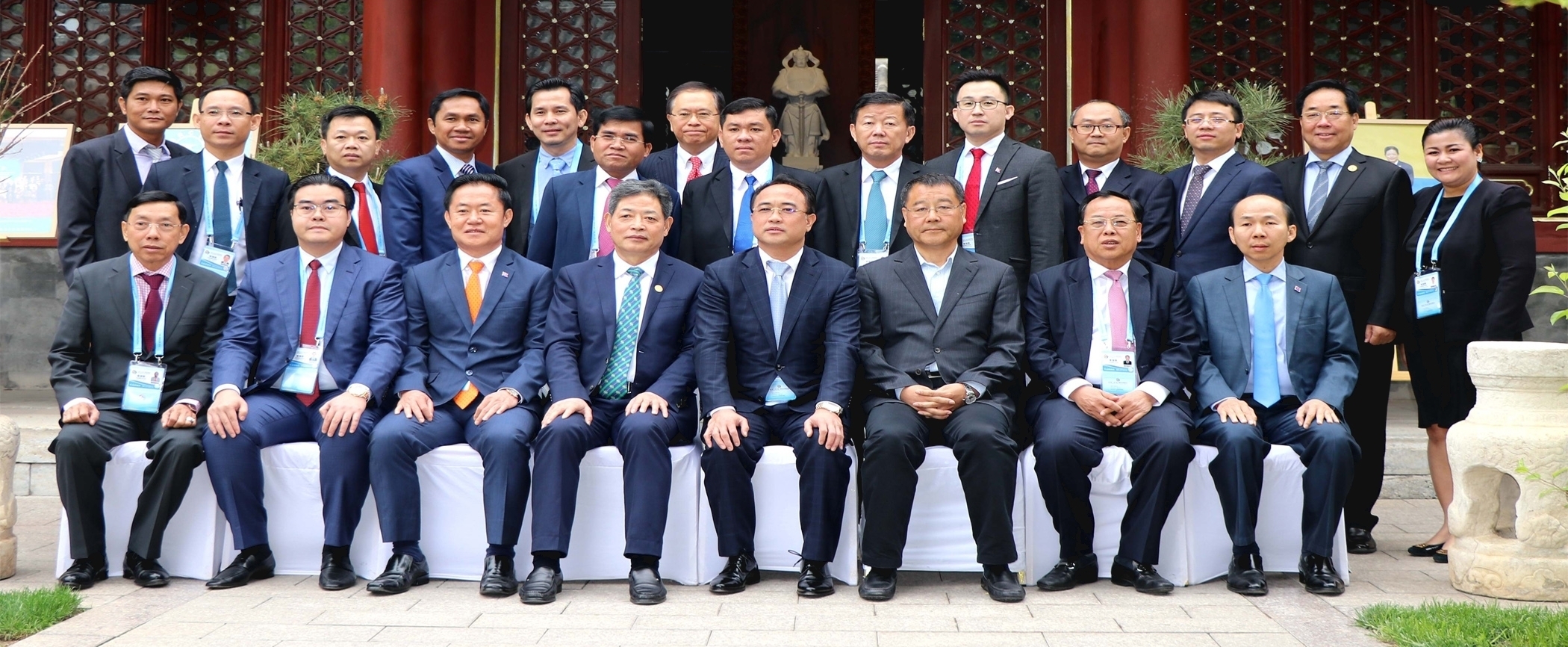

The picture shows Chinese Premier Li Qiang (center) taking a group photo with Amb. Francis Chua (fifth from left, front row) and well-known ASEAN entrepreneurs.

Philippine Chamber of Commerce and Industry News:Ambassador Francis Chua, Permanent Honorary Chairman of the Philippine Chamber of Commerce and Industry, Founding Chairman of the Philippine International Chamber of Commerce and Founding Chairman of the Philippine Silk Road International Chamber of Commerce as well as the SRCIC Vice Chairman, at the invitation of the host, Ministry of Commerce of China, China Council for the Promotion of International Trade, the Government of Guangxi Autonomous Region and Guangxi Council for the Promotion of International Trade, on September 15, went to Nanning, Guangxi Province to attend the 20th China-Asean Expo and China-Asean Business and Investment Summit, and as the only representative guest of the Philippines, met with Chinese Premier Li Qiang and took photos with well-known ASEAN entrepreneurs, and attended the State banquet.

The theme of this East Expo is "Building a home with harmony and Coexistence, Sharing the Future with Destiny - Promoting high-quality Development of the Belt and Road and Building an Economic Growth Center", during which the side meeting on the theme of "Institutional Opening: At "New Pattern of Regional Economic Development" will be held the first time. Representatives from ASEAN countries will have in-depth discussions and exchanges on the steady expansion of institutional openness of rules, regulations, management and standards in the region. At the same time, activities such as the "Year of Investing in China - Entering Guangxi" special event and the "Face to Face with the Business Counsellors of Chinese Missions in 10 ASEAN countries" exchange meeting will also be held to showcase China's investment opportunities, build a platform for multinational companies to understand China and invest in China, and convey to the world China's confidence and determination to unswervingly promote a high level of opening-up.

This East Expo will focus on China-Asean Free Trade Area 3.0, RCEP, the "Belt and Road" and other multilateral and bilateral cooperation mechanisms, continue to hold the third RCEP Summit Forum and other institutional activities, issued the "China-Asean Free Trade Area 3.0 Business Opportunities Outlook" blue book, guide regional enterprises to better grasp the new economic and trade rules, better share the RCEP high-quality implementation of the new dividends.

Writer/Picture:Pol Ongkinglok

Linguister/Editor:Stephanie Tan

Qinghai's Achievements in Practicing Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era

Qinghai's Achievements in Practicing Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era

14 Sep 2023

Qinghai's Achievements in Practicing Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era,cohosted by the International Department of the CPC Central Committee and the CPC Qinghai Provincial Committee, was held in Xining,Qinghai Provinceon September12. The theme of the event was Chinese Modernization: Harmony Between Humanity and Nature.Over 150 political party leaders or representatives from nearly 30 countries attended the event in person and online.

Mr. Mohammad Omer,the SRCIC member andDirector of the China-Africa Center for Technology Transfer and Commercialization,was invited to the event. Mr. Omer expressed his appreciation and thanks to the International Department of the CPC Central Committee and the CPC Qinghai Provincial Committee for co-hosting this important event. He underlined how the world can learn from Qinghai's experience of Chinese Modernization in the New Era. Andpointed out that this eventrelates well to the Global Development Initiative proposed by H.E. President Xi and where China-Africa Center for Technology Transfer and Commercialization signed its Declaration. In conclusion, Mr. Omer said that Qinghai's success on achieving harmony between mankind and nature contributes to the realization of the Green Silk Road and Building Jointly an Ecological Community of Shared Future for Mankind.

Adnan Akfirat - A miracle in the heart of Asia: Horgos!

Adnan Akfirat - A miracle in the heart of Asia: Horgos!

5 May 2023

By Adnan Akfirat,Chairman of the Turkish-Chinese Business Development and Friendship Association

Can there be a port at the farthest distance from the sea?

I went to the Horgos Free Economic Zone, known as the world's largest dry port, which is crossed by both road and rail and will soon have air service. I have seen it, I am writing about it!

AT THE INACCESSIBILITY POLE OF EURASIA

The Horgos Free Trade Economic (FEZ), a joint creation of both countries on the China-Kazakhstan border, lies at the foot of what is known as the Eurasian Pole of Inaccessibility. The Pole of Inaccessibility is a geographical term. It refers to the geographical region on a continent farthest from the seas.

This is the ingenuity of the Asian Century: Eurasia's Pole of Inaccessibility is now the crossroads of transcontinental transportation and manufacturing.

Horgos FEZ, in the north of the Xinjiang Uygur Autonomous Region, on the China-Kazakhstan border, is at the very heart of Asia. And it serves as the heart of trade not only to Asia but also to three continents, including Europe and Africa. Asia and Europe's products pass Horgos by road and rail to reach their destinations. Products arriving by sea are also transported by land and rail to the ends of Asia via Horgos.

Cargo containers that arrive at Horgos FEZ in 5 days by rail from the port city of Lianyungang in eastern China can reach the city of Duisburg in northwestern Germany in 10 days. This connection route, which is 3 times faster than sea transportation and half the cost of air transportation, offers an alternative to investors in terms of time and cost. Goods purchased from Horgos FEZ can be freely shipped to CIS countries without any additional customs inspection or tax.

HERODOTUS' LEGEND COMES TRUE!

Horgos is a historical gateway. It has long been called the Dzungarian Gate (or Altai Pass). It is the only pass through the 4,800-kilometer mountain wall stretching from Manchuria to Afghanistan. It is a convenient natural gateway for riders on horseback between the western Eurasian steppes and the lands further east. It has also been noted for its fierce and almost constant winds.

In his "Histories", Herodotus quotes travelers' reports of a country in the northeast where men with the bodies of lions and the wings of eagles guarded the gold and the North Wind came out of a mountain cave. Hyperborea, a term meaning beyond the point where Boreas, the god of the North Wind, breathed his breath, is the name of a mythical land in Greek Mythology beyond the North Wind, where the sun never fails to shine, the trees are always full of fruit and the meadows are always green. Some scholars argue that there is a connection between the Dzungarian Gate and the home of Boreas, the creator of the North Wind in Greek mythology. Because this gate is at the foot of the Altai Mountains, named after the Golden Mountain. Horgos have replaced the house of Boreas!

BREAKING NEW GROUND IN INTERNATIONAL COOPERATION

The Horgos FEZ is intended to be a game-changing catalyst for international cooperation and trade.

Officially called the International Center for Border Cooperation (ICBC), the five-square-kilometer Free Economic Zone is located in the middle of the Saryesik-Atyrau desert, 670 kilometers west of Urumqi and 380 kilometers east of Almaty.

Horgos, in the Ili Kazakh Autonomous Prefecture of China's Xinjiang Uyghur Autonomous Region, means "the place where camel caravans pass" in Mongolian and "the place where wealth accumulates" in Kazakh.

The new city of Horgos on the Chinese side, the size of New York City, is like an oasis in the desert. On the Kazakh side, the developing Horgos-East Gate Special Economic Zone is recovering rapidly after the pandemic. Many of the China-Europe rail lines pass through here.

Horgos is also the crossroads of the Western Europe-Western China Highway from the Yellow Sea to the Baltic. It is a successful implementation of the Belt and Road Initiative, a massive economic cooperation-trade network of interconnected land and sea ports, special economic zones, new cities, and free trade zones in which 134 countries in Eurasia, Africa, and South America are actively participating.

Horgos is positioned as a gateway for international trade linking east and west and a bridgehead for the opening of the Xinjiang Uygur Autonomous Region to the west. It is the world's first cross-border international free economic zone and China's first special economic zone "inside the country but outside the jurisdiction of customs".

Moreover, with the facilities provided by the Chinese central government and the strong interest of the Uyghur Autonomous Region, the Horgos Local Government offers very attractive investment incentives for setting up manufacturing facilities. The incentives offered by both China and Kazakhstan for Horgos FEZ to become a production base deserve the attention of investors.

THE BRIGHT ROAD OF KAZAKHSTAN

When it first opened in December 2011, the Khorgos FEZ was heralded as a cornerstone of China-Kazakhstan bilateral relations and a prime example of Kazakhstan's broader "Nurlu Yol" plan to diversify its economy beyond energy exports.

Presented in promotional materials as "a huge new city of the future where two civilizations intersect," Horgos FEZ is envisioned as a multicultural economic crossroads where Central Asian Turks, Russians, and Chinese can come together to buy each other's goods, eat each other's cuisine and consume each other's entertainment and culture.

A new city is being built on the Kazakhstan side of the Horgos FEZ. Nurkent is expected to be home to 100,000 people. The first zone is 90% complete. It was announced that the entire development and construction of Nurkent City Phase One will be completed in September 2023. It is planned to be fully completed by 2035. Nurkent is seen as a vehicle to help resettle workers at the Khorgos-East Gate, the largest transportation and logistics hub in the Belt and Road Initiative. These workers will be retrained as a permanent source of labor for the Horgos FEZ, which is already a major trade hub between Kazakhstan and China and is developing into a favored manufacturing zone.

HUGE WORK IN LESS TIME

The Chinese side of Horgos consists of five giant four-story wholesale markets. They are located side by side in blocks, with wide sidewalks and roads between them. No personal vehicles are allowed within the area, and public golf carts and vans transport customers from the shopping complex to the shopping complex. New wholesale markets continue to be added, while unfinished construction projects take up much of the land.

Like Chinese wholesale markets, the inside of the malls is made up of hundreds of small shops and booths rented by individual vendors. Most of the buildings, floors, and corridors are organized by product type. Vendors call out to you as you walk through aisles filled with huge waist-high piles of goods.

But it is important to remember that this is not just a new free trade zone, but an entirely new economy being created. ICBC is just one part of a multi-pronged development initiative to build an entirely new trade, manufacturing, and logistics zone where none existed before. The adjacent Horgos special economic zone is estimated to attract 30,000 workers and their families, while the city of Horgos is being built for 200,000 people. Such large-scale development anywhere takes decades, not just years. China did it in 10 years.

TUCEM OPENS TURKISH BRANDS TO CHINA FROM HORGOS

At the invitation of Mr. Ma Fuming, President of Horgos International Chamber of Commerce, we as the Turkish-Chinese Business Matching Center delegation Mr, Serdar Kulu, Director of TUCEM Xinjiang Uyghur Autonomous Region, and I spent four full days in Horgos between April 26-30. Mr. Rutkay Çakırkaya, the owner of Balizza, one of Turkey's leading women's clothing brands, joined us coming from through Kazakhstan. We were received by Mr. Hao Jianmin, the CCP Secretary of Horgos. The Uyghur, Kazakh, Hui, and Han officials of the Horgos Local Government mobilized with sincere interest to provide the best service.

Here is our good news: On August 12-14, we are organizing a special exhibition and fashion show with Turkish clothing brands in Horgos International Free Economic Zone. Hao Jianmin, Secretary of Horgos CPC, has committed to bringing a delegation of 1000 buyers, including all major garment buyers from the eastern region of China. Turkey is organizing the first international event of Horgos FEZ in a magnificent venue built in the shape of a Chinese Palace. We will continue to report good news from Horgos!

Business people would come to Xinjiang to do business if they were smart enough: Adnan Akfırat

Business people would come to Xinjiang to do business if they were smart enough: Adnan Akfırat

7 Apr 2023

I have been in Urumqi, the capital of the Xinjiang Uyghur Autonomous Region, for a week. It snowed two days long, but now spring is in full bloom. It is invigorating with a blue sky that is rarely seen in Shanghai and fresh clean air. During the holy month of Ramadan, we are in a society that fulfills the obligations of Islam. There is peace and respect for faith.

I will follow the proverb attributed to the great traveler, scholar, and linguist Evliya Çelebi (1): “Keep what you eat and drink and tell what you see”.

The biggest economicdevelopment in progress

According to the 2023 Program of the Government of the Xinjiang Uyghur Autonomous Region, the Region will achieve the fastest economic development in its history in the next five years. The government program, presented by Autonomous Region Chairman Erkin Tuniyaz at the opening session of the 14th People's Assembly of the Xinjiang Uyghur Autonomous Region on January 16, 2023, makes this claim. Erkin Tuniyaz stated that the plan is to exceed China’s national average in all economic indicators over the next five years and announced a GDP growth target of 7 percent for 2023.

The link to grasp: opening up!

In politics, there is a concept called the “ring to grasp”. It is used to refer to the step that, how you tackle and solve a set of problems that come your way, this paves the way for the solution of other problems. In the Uyghur Autonomous Region's “economic boom”, opening up to the outside world has been identified as the “Ring to Grasp”. Xinjiang CPC Secretary Ma Xingrui's experience as the governor of Shenzhen city and Guangdong province played a major role in this change. Prof. Ma Xingrui, one of China’s renowned rocket scientists, was elected to the Political Bureau of the Central Committee at the 20th Congress of the CPC. He is currently ranked 8th in the CPC hierarchy.

Ma Xingrui, who became the Party secretary of the Uyghur Autonomous Region in December 2021 with the great support of the Xi Jinping administration, brought a breath of fresh air to Xinjiang, which we covered in our article titled “More Socialism, Happier Uyghurs” dated June 10, 2022, at Aydinlik Daily in Turkish.

Ma Xingrui is prioritizing a high level of opening up to make Xinjiang a core region of the “Silk Road Economic Belt”, one of the two main pillars of the Belt and Road Initiative.

Neighboring 8 countries, the region is making an intensive effort to mobilize the opportunities of its geographical location. Erkin Tuniyaz announced the full resumption of all services at the Uyghur Autonomous Region's 13 land ports at the beginning of the year.

In an interview with CGTN, Kaiser Abdulkerim, Vice President of the Autonomous Region, explains how they will achieve 7 percent growth: “We will vigorously promote the economic vitality of various market actors; we will create an efficient and good business environment for state-owned enterprises to be bold, private enterprises to be daring, and foreign enterprises to be eager to invest. In the future, we will promote the modernization of agriculture, and support the stable production and quality improvement of the cotton industry. We are very excited to welcome visitors from all over the world. This is a multi-religious, multi-ethnic, multi-cultural society and a place where different civilizations live together. In the coming days, we will utilize these advantages to launch the ‘Xinjiang Tourism Development’ initiative.”

Ma Xingrui's first trip abroad

On Monday, March 27, Ma Xingrui led a large Sichuan government delegation on an official visit to Kazakhstan and Uzbekistan, and Kyrgyzstan. Ma Xingrui is said to have assumed central responsibility for China's opening to the West.

CPC secretaries of provinces and autonomous regions rarely travel abroad. Ma Xingrui was received at the highest level in Kazakhstan, Uzbekistan, and Kyrgyzstan.

In Astana, he met with President Kassym Jomart Tokayev and Prime Minister Alikhan Smailov, and in Tashkent with Uzbek President Shavkat Mirziyoyev and in Bishkek with KyrgyzPresident Sadyr Japarov.

President Tokayev said Kazakhstan wants to deepen cooperation with China on the basis of strategic partnership and eternal friendship. “We are ready to work with our Chinese colleagues to increase trade volume to $35 billion by 2030,” Prime Minister Smailov said.

Smailov and Ma also discussed measures to eliminate bottlenecks at the border. Green corridors have already been opened at two of the five checkpoints. Ismailov also raised the issue of speeding up visa processing for Kazakh trucks entering China.

Ma Xingrui said, “As a region of China, we are responsible for the country’s ties with the West. We see Kazakhstan as a top priority area of cooperation. In general, China’s cooperation with Kazakhstan is carried out through Xinjiang.”

On November 29, during his visit to Uzbekistan, it was announced that they discussed the implementation of joint projects in the field of renewable energy, the development of transport infrastructure, the creation of industrial parks and agricultural clusters in Uzbekistan with the participation of leading Chinese companies. Mutual interest in accelerating the Uzbekistan-Kyrgyzstan-China railway construction project was emphasized.

President Mirziyoyev's office said in a statement: “It is with deep satisfaction that we note the fruitful results of the historic summit held in Samarkand in September last year, which marked the beginning of a new era in Uzbek-Chinese comprehensive strategic partnership relations.” It said.

Ma Xingrui said the purpose of his visit was “to build a bridge of friendship and cooperation between the north and south of the Tienshan and to enable Xinjiang to contribute to writing a new page of friendship between China and Uzbekistan.”

KyrgyzPresident Sadyr Japarov, touching upon China-Kyrgyzstan-Uzbekistan railway construction projectnoted that itwould contribute tothe deepening oftrade and economic cooperation between Kyrgyzstan and XUAR, and would also have amultiplicative effect onthe development ofother sectors ofthe economy.

Inparticular, the parties signed memorandums ofintent toexport electricity toChina and build a500-kilovolt power transmission line Kyrgyzstan-China and small hydropower plants in Bishkek.

Xinjiang really opens to the west with Türkiye

The biggest longing of Uyghurs living in the region is access to Turkish goods. The demand for closer economic cooperation with Türkiye has also been the aspiration of the Autonomous Region's administration, which has made “opening up Xinjiang to the west” a top priority. During our meeting in Urumqi on July 5 last year, Ma Xingrui expressed this desire very strongly and invited us to play a role in developing relations with Türkiye.

Indeed, on Tuesday, March 28, we met with a large government delegation led by Xing Tao, the head of the Trade Administration of the Xinjiang Uyghur Autonomous Region. Xinjiang officials responded positively to all of our requests, reflecting the will of Ma Xingrui.